Generate More Revenue per Merchant

DisputeHelp provides ISOs, acquirers & MSPs with comprehensive white-labeled dispute management tools including dispute deflection, chargeback alerts, and representment – all in one portal.

Reduce processing risks in your portfolio.

Select from a range of white-labeled tools designed to keep your merchant accounts healthy. Partner with the leading experts.

Leverage our intuitive and highly integrated technologies to automate processes and streamline workloads. Prevent disputes. Reduce chargebacks. Fight fraud.

Senior Relationship Manager, Top U.S. Merchant Service Provider

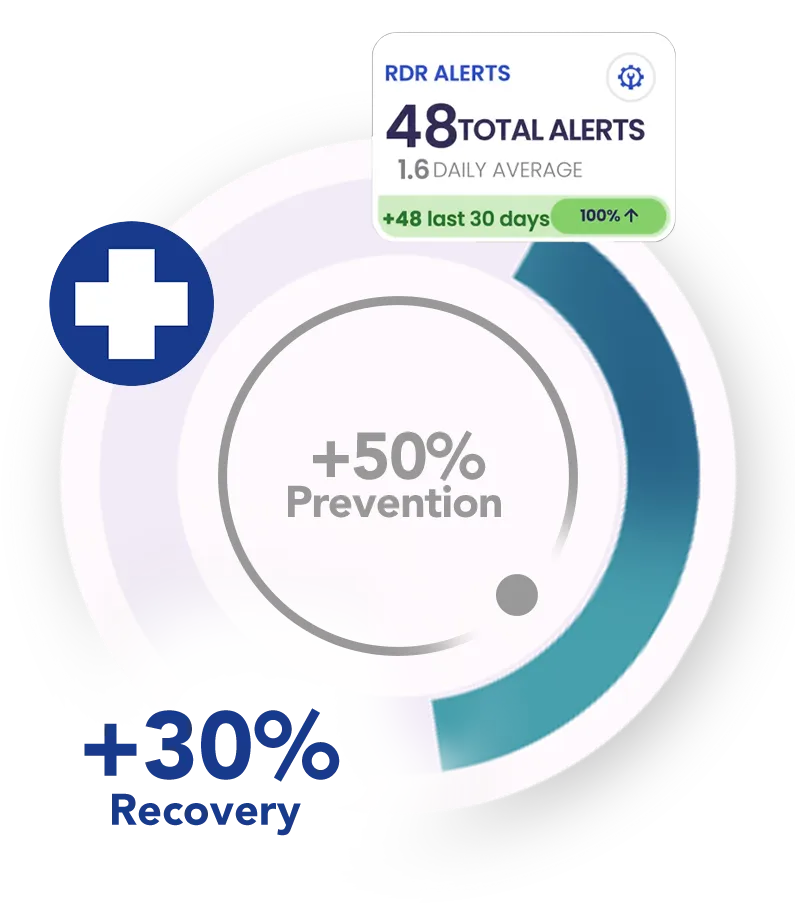

Since implementing DisputeHelp, we’ve reduced our onboarded clients’ chargeback ratios by 50% on average and brought several high-risk merchants back within accepted chargeback thresholds.”

Reduce processing risks in your portfolio.

Select from a range of white-labeled tools designed to keep your merchant accounts healthy. Partner with the leading experts.

Leverage our intuitive and highly integrated technologies to automate processes and streamline workloads. Prevent disputes. Reduce chargebacks. Fight fraud.

“Since implementing DisputeHelp, we’ve reduced our onboarded clients’ chargeback ratios by 50% on average and brought several high-risk merchants back within accepted chargeback thresholds.”

Senior Relationship Manager, Top U.S. Merchant Service Provider

Benefits of Partnering with DisputeHelp

Prevent Chargebacks

Processing Protection

Greater Operational Efficiency

More Revenue per Merchant

Reduce Processing Risk

Increased Merchant Satisfaction

Stay Compliant with Evolving Regulations

Mitigate Fraud Losses

Improve Transaction Acceptance

Improve Chargeback Win Rates

Recover Lost Revenue

Streamline Tools to 1 Platform

Benefits of Partnering with DisputeHelp

Prevent Chargebacks

Processing Protection

Greater Operational Efficiency

More Revenue per Merchant

Reduce Processing Risk

Increased Merchant Satisfaction

Stay Compliant with Evolving Regulations

Mitigate Fraud Losses

Improve Transaction Acceptance

Improve Chargeback Win Rates

Recover Lost Revenue

Streamline Tools to 1 Platform

About Us

The World’s Leading Experts in Dispute Prevention

DisputeHelp integrates the most effective tools available to help merchants prevent disputes, reduce chargebacks and recover revenue. We manage the backend integrations, and we white-label the frontend.

Protect your merchants from disputes and post-authorization fraud with DisputeHelp. Our platform provides dispute management for acquirers and MSPs to resell with their existing merchant services. We handle all the integrations.

But technology is just part of the equation.

We provide you with the training to master our tools and offer ongoing support as partners in your success.

While other companies leave you to your own devices, we pride ourselves on a more

human-centric approach that ensures better results, and less stress.

End-to-end Dispute Management

Our platform provides ISOs, MSPs and acquirers worldwide with white-label solutions for streamlining transaction disputes, fraud, and chargebacks for merchant portfolios. We handle the complex integrations, ongoing maintenance, and compliance required to prevent chargebacks and recover lost revenue. This creates a new revenue stream, adding value to your merchant services.

End-to-end Dispute Management

Our platform provides ISOs, MSPs and acquirers worldwide with white-label solutions for streamlining transaction disputes, fraud, and chargebacks for merchant portfolios. We handle the complex integrations, ongoing maintenance, and compliance required to prevent chargebacks and recover lost revenue. This creates a new revenue stream, adding value to your merchant services.

Mobilize your transaction data in real time

Send that data on-demand to issuer & cardholder inquiries

Inform transaction confusion & disrupt first-party fraud

Stop disputes before they start

Reduce risk exposure by eliminating fraud & chargebacks

Provide your merchants with automated dispute resolution

Deploy multiple solutions through a single integration

Lower fraud & chargeback ratios = increased auth rates

Help merchants reclaim revenue from unwarranted chargebacks

Improve the rebuttal workflow for all stakeholders

Automated compelling evidence in real time, on demand

Full data access & reporting for full accountability

No Nonsense Onboarding

We get you up-and-running fast with quick integration so you can start empowering your merchants with turnkey fraud protection solutions. Our platform adapts to your tech stack, not the other way around.

No hidden fees

No long term contract

No IT required

No barriers to entry

One-Stop

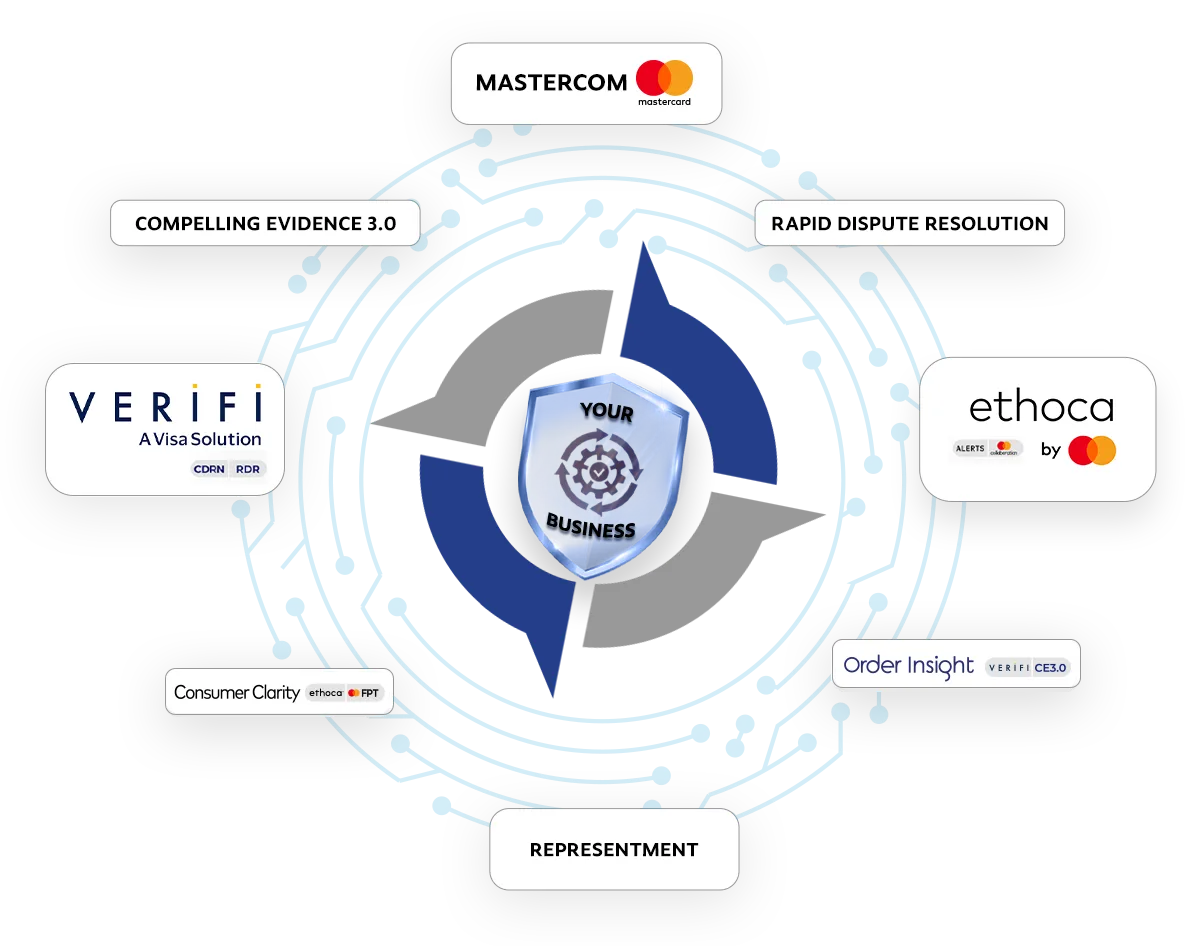

DisputeHelp is the unified chargeback operations platform built for payment professionals like you. We integrate tools from Visa, Mastercard, Verifi, and Ethoca into a single platform.

One login, one workflow – every dispute, every alert, fully centralized.

Connects all sources

Verifi CDRN, Compelling Evidence 3.0, Order Insight, Rapid Dispute Resolution (RDR), Ethoca Alerts, Mastercom Collaboration, Consumer Clarity, Representment

Tracks every dispute in real time across issuers, schemes, and alert types

Automates evidence preparation with templates optimized per brand

Exports case performance for audits, board reviews, and SLA monitoring

Save Precious Time

Empower your merchants to spend more time growing the business, less time worrying about chargebacks. Let our platform handle the mind-numbing legwork for all parties.

Say Goodbye to:

Toggling between portals for different issuers and tools.

Manual uploading and downloading of reports.

Maintaining spreadsheets for tracking.

Hand-holding merchants through the processes.

Become a KPI Champ

We speak your language:

Efficiency, compliance, throughput, and ultimately – money saved.

The results will speak for themselves on your P&L.

Time to Resolution

Reduce lag with automated alerts, task routing, and real-time statuses

SLA Adherence

Pre-built timelines and issuer-aligned logic ensure your merchants stay within windows

Audit-Ready Transparency

All data exportable, filterable, and aligned to regulatory and leadership reporting

Win Rate Optimization

Evidence builders and workflows align with issuer behavior and brand-specific rules

Futureproof Your Operations

Fraudsters will find new strategies to swindle.

The card brands will continue to modify the regulations.

Regulations will tighten.

But don’t worry… we have you covered.

DisputeHelp evolves with every industry change – so you’re always ahead, never scrambling to catch up.

But Don’t Just Take Our Word

See how leading PSP teams are consolidating chargeback workflows and improving performance with less manual effort.

Request a tailored platform walkthrough based on your dispute volumes and current tools (no obligation)

Get a free operational audit to benchmark your current performance

Preview real dashboards, recovery metrics, and report templates

Frequently Asked Questions

How can MSPs stay compliant with regulations including VAMP?

MSPs can keep their merchants’ ratios in check by implementing real-time monitoring, engaging merchants proactively, and leveraging automated dispute resolution tools. DisputeHelp offers all these capabilities in a single platform.

What are chargeback alerts and how do they work for MSPs?

Chargeback alerts are real-time notifications that inform MSPs and their merchants when a cardholder initiates a dispute with their issuer. This allows for quick action to resolve the issue before it becomes a formal chargeback. By responding to these alerts, MSPs can help merchants avoid penalties, protect their accounts, and improve overall portfolio health.

What implementation options does DisputeHelp offer?

DisputeHelp supports multiple integration methods, including API, dashboard, and email. This flexibility allows MSPs to choose the approach that best fits their existing systems and operational needs. White-label options are also available for those who want to offer a branded experience to their merchants.

What makes DisputeHelp’s chargeback alert solution unique for MSPs?

DisputeHelp offers advanced automation, support for all major alert networks, and robust white-label capabilities. Our platform is built for scale, with granular reporting and flexible integration options. Transparent pricing and dedicated support set DisputeHelp apart from other providers.

Can DisputeHelp’s services be white-labeled?

Absolutely. MSPs can offer the entire DisputeHelp platform—DEFLECT, RESOLVE, and RECOVER—under their own brand. This enhances client trust and supports long-term retention.

How quickly can DisputeHelp automation be deployed?

DisputeHelp’s platform is designed for fast deployment across entire merchant portfolios. Contact our team here to learn exactly how long it will take for your business and what you can expect throughout the process.

DisputeHelp provides ISOs, acquirers and MSPs with full-spectrum white-label dispute management solutions for their merchant portfolios.